Achieving financial freedom is a goal many aspire to. The right books can guide you on this journey.

In this blog post, we’ll explore the best books for financial freedom. These books offer practical advice and proven strategies. They cover topics like building wealth, saving, investing, and planning for early retirement. “The Black Girl’s Guide to Financial Freedom” empowers readers with steps to build wealth and retire early.

“The Total Money Makeover” presents a clear plan for financial peace. “The Roadmap to Financial Freedom” provides a guide to automated wealth. “Rich Dad’s CASHFLOW Quadrant” offers insights on financial independence. These books, among others, can help you achieve your financial goals and live the life you desire. Dive in and find the right guide for your financial journey.

The Black Girl’s Guide To Financial Freedom: Build Wealth, Retire Early, And Live The Life Of Your Dreams

“The Black Girl’s Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your Dreams” is an empowering book aimed at helping individuals achieve financial independence. Written with a focus on the unique challenges faced by Black women, this guide provides actionable advice and strategies to build wealth, retire early, and live a fulfilling life.

Pros:

- Empowering content tailored for Black women.

- Practical strategies for building wealth and achieving financial freedom.

- Comprehensive guide covering various aspects of personal finance.

- Easy to understand and implement tips.

Cons:

- Limited appeal to audiences outside the target demographic.

- Basic financial concepts may be redundant for those with advanced knowledge.

The Black Girl’s Guide to Financial Freedom stands out as a unique resource tailored specifically for Black women. The brand behind the book is Generic, and it is published by Freedom Unlimited LLC. With dimensions of 8.5 inches in height, 0.46 inches in width, and 5.5 inches in length, and weighing 0.52029093832 pounds, this guide is conveniently sized for easy reading and portability. The book spans 201 pages and was published on September 18, 2021.

This guide not only provides empowering content but also practical strategies to help readers take control of their finances. While it might have limited appeal to those outside the target demographic, its focus on easy-to-understand and actionable advice makes it a valuable resource for those looking to improve their financial literacy. For Black women looking to build wealth and retire early, this book offers a comprehensive and approachable guide to achieving these goals.

To buy this product, click here.

The Total Money Makeover Updated And Expanded: A Proven Plan For Financial Peace

“The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace” is a comprehensive financial guide designed to help individuals achieve financial stability and independence. The book offers practical advice and a step-by-step plan to manage finances effectively.

Pros:

- Provides a proven plan for financial management

- Written by a reputable author

- Includes updated and expanded content

- Suitable for all ages

Cons:

- May require significant lifestyle changes

- Not suitable for advanced financial experts

“The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace” is an essential read for anyone looking to take control of their finances. The book is authored by Audible and published by Thomas Nelson, ensuring high-quality and reliable content. With a publication date of May 14, 2024, this updated edition includes the latest strategies and insights to help readers achieve financial peace.

One of the standout features of this book is its practical approach to financial management. It breaks down complex financial concepts into easy-to-understand steps, making it accessible for readers of all ages. However, it’s important to note that following the plan may require significant lifestyle changes, which could be challenging for some. Despite this, the book’s proven track record and reputable authorship make it a valuable resource for anyone looking to improve their financial situation.

To buy this product, click here.

The Roadmap To Financial Freedom: A Millionaire’s Guide To Building Automated Wealth

The Roadmap to Financial Freedom: A Millionaire’s Guide to Building Automated Wealth is a comprehensive guide designed to help individuals achieve financial independence through strategic planning and automation. Published by Wiley, this book measures 9.098407 inches in height, 1.098423 inches in width, and 6.200775 inches in length, with a weight of 2.314853751 Pounds. This first edition features 224 pages and is scheduled for release on April 16, 2024.

Pros:

- Comprehensive guide to financial independence.

- Focus on automated wealth-building strategies.

- Published by a reputable publisher, Wiley.

- Detailed and easy-to-understand content.

Cons:

- May be too advanced for beginners.

- Limited to strategies that may not apply to all financial situations.

The Roadmap to Financial Freedom: A Millionaire’s Guide to Building Automated Wealth is an essential read for anyone serious about achieving financial independence. The book provides a detailed plan that leverages automated strategies to build wealth, making it an invaluable resource for those looking to simplify their financial journey. With its clear and concise content, readers can easily understand and implement the techniques discussed.

However, the book may not be suitable for everyone, especially those who are new to personal finance. Some of the strategies may seem complex and require a certain level of financial literacy to fully grasp. Additionally, while the book offers a wealth of knowledge, it is important for readers to consider their own unique financial situations and adapt the strategies accordingly. Overall, this guide is a powerful tool for those ready to take control of their financial future.

To buy this product, click here.

Rich Dad’s Cashflow Quadrant: Rich Dad’s Guide To Financial Freedom

Rich Dad’s CASHFLOW Quadrant: Rich Dad’s Guide to Financial Freedom is a book that explores the different ways people can achieve financial freedom. Written by Robert T. Kiyosaki, this book is a follow-up to his best-selling book Rich Dad Poor Dad. It offers insights on how to shift from the traditional path of employment to entrepreneurship and investment.

Pros:

- Provides a clear explanation of the CASHFLOW Quadrant.

- Encourages readers to think about financial independence.

- Practical advice on how to move from employee to investor.

- Easy to understand language and real-life examples.

Cons:

- Some concepts may seem repetitive for those who have read Rich Dad Poor Dad.

- Can be overly simplistic for experienced investors.

The CASHFLOW Quadrant introduced in the book divides people into four categories: Employees (E), Self-Employed (S), Business Owners (B), and Investors (I). The book emphasizes the importance of moving from the left side of the quadrant (E and S) to the right side (B and I) for achieving financial freedom. Kiyosaki argues that being on the right side allows individuals to leverage other people’s time and money, leading to greater financial success and independence.

One of the key features of the book is its practical advice on how to transition from being an employee to an investor. Kiyosaki provides numerous examples from his own life and the lives of his rich dad and poor dad to illustrate his points. This makes the concepts more relatable and easier to understand. However, some readers may find the advice too simplistic or repetitive, especially if they are already familiar with Kiyosaki’s previous work.

To buy this product, click here.

Retire Before Mom And Dad: The Simple Numbers Behind A Lifetime Of Financial Freedom

“Retire Before Mom and Dad: The Simple Numbers Behind A Lifetime of Financial Freedom” is a comprehensive guide that helps readers achieve financial independence early in life. Written by Glenbrook Press, this book provides actionable strategies and insights for managing finances effectively and planning for an early retirement. The book’s dimensions are 9.0 inches in height, 0.67 inches in width, and 6.0 inches in length, weighing approximately 0.917 pounds. It consists of 268 pages and was published on August 29, 2019.

Pros:

- Easy-to-understand financial concepts and strategies

- Actionable advice and practical tips

- Comprehensive coverage of financial planning and retirement strategies

- Engaging writing style that keeps readers interested

Cons:

- Some strategies may require significant lifestyle changes

- May not cover complex financial situations in detail

“Retire Before Mom and Dad: The Simple Numbers Behind A Lifetime of Financial Freedom” is an invaluable resource for anyone looking to take control of their financial future. The book simplifies complex financial concepts, making them accessible to readers of all backgrounds. It provides a clear roadmap for achieving financial independence and offers practical, step-by-step advice on how to implement these strategies in real life.

One of the standout features of the book is its engaging writing style, which keeps readers hooked from start to finish. The author’s approach to financial planning is both holistic and practical, ensuring that readers can easily understand and apply the advice given. However, it’s important to note that some of the strategies may require significant lifestyle changes, and the book may not fully address more complex financial situations. Despite these minor drawbacks, “Retire Before Mom and Dad” remains an essential guide for those aiming to achieve financial freedom early in life.

To buy this product, click here.

Financial Literacy For Young Adults Simplified

“Financial Literacy for Young Adults Simplified: Discover How to Manage, Save, and Invest Money to Build a Secure & Independent Future” is a comprehensive guide aimed at helping young adults understand the basics of managing their finances. The book, authored by Ubsvaky and independently published, covers essential topics such as budgeting, saving, and investing, all in a simplified manner.

Pros:

- Easy-to-understand language suitable for young adults.

- Comprehensive coverage of financial topics.

- Practical tips for real-life financial management.

- Compact size makes it easy to carry around.

- Recent publication date ensures up-to-date information.

Cons:

- Limited number of pages may not cover all advanced topics in depth.

- Focus on basics might be too elementary for those with some financial knowledge.

The book’s easy-to-understand language makes it an excellent starting point for young adults who are new to the world of finance. It covers a broad range of topics, from budgeting and saving to investing, offering practical tips that can be applied in real life. The compact size of the book also makes it convenient to carry around, allowing readers to refer to it whenever needed.

However, the book’s limited number of pages means that it may not delve deeply into more advanced financial topics. Additionally, those who already have some knowledge of financial management might find the book’s focus on basics to be too elementary. Despite these limitations, “Financial Literacy for Young Adults Simplified” is a valuable resource for anyone looking to build a strong foundation in managing their finances effectively.

To buy this product, click here.

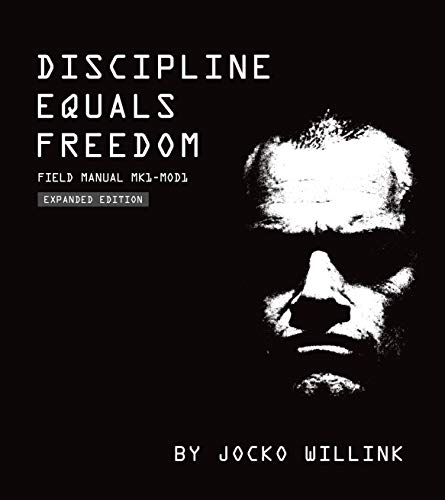

Discipline Equals Freedom: Field Manual Mk1-mod1

“Discipline Equals Freedom: Field Manual Mk1-MOD1” is a comprehensive guidebook authored by Jocko Willink. It provides readers with practical advice on achieving discipline and freedom in their personal and professional lives. This expanded edition is packed with motivational insights and actionable strategies to help you overcome obstacles and unlock your full potential.

Pros:

- In-depth insights from a renowned Navy SEAL.

- Expanded edition with additional content.

- Compact and durable with high-quality binding.

- Motivational and practical advice for everyday use.

- Visually appealing design and layout.

Cons:

- Weight might be cumbersome for some users.

- Repetitive content for those familiar with the author’s previous work.

- High price point compared to similar books.

The “Discipline Equals Freedom: Field Manual Mk1-MOD1” is a remarkable resource for anyone looking to instill discipline in their life. Authored by the renowned Navy SEAL, Jocko Willink, this book offers a blend of motivational content and practical advice. Its expanded edition includes new sections that provide even more value, making it a worthwhile investment for both new readers and fans of Willink’s previous works.

One of the standout features of this manual is its durable binding and high-quality design, which makes it not only a useful guide but also a visually appealing addition to any bookshelf. However, potential buyers should consider its weight and price point, as it may not be the most portable option and could be more expensive than similar books in the market. Despite these minor drawbacks, the practical strategies and motivational insights offered in this book make it an excellent tool for those committed to personal growth and achieving their goals.

To buy this product, click here.

Financial Freedom Simplified: A Guide For Building Wealth

Financial Freedom Simplified: A Guide for Building Wealth is a comprehensive book designed to help individuals achieve financial independence. Authored by Hweryho and published by Reid All About It Publishing, this guide provides readers with practical strategies and insights for building wealth and managing finances effectively.

Pros:

- Comprehensive and easy-to-understand content

- Written by an experienced author in the field

- Includes actionable steps and real-life examples

- Detailed guidance on various aspects of personal finance

- Well-structured and organized for easy reference

Cons:

- Some concepts may be too advanced for beginners

- Lengthy book with 372 pages might be overwhelming for some readers

- Publication date of 2022 may mean some information is slightly outdated

Financial Freedom Simplified: A Guide for Building Wealth is an invaluable resource for anyone seeking to take control of their financial future. The book’s comprehensive approach covers everything from budgeting and saving to investing and retirement planning. With 372 pages of detailed information, readers are sure to find strategies and tips that will help them improve their financial situation.

One of the standout features of this book is its practicality. The author, Hweryho, uses real-life examples and actionable steps to guide readers through the complexities of personal finance. While the book is thorough, it is also well-organized, making it easy for readers to find specific information when needed. However, due to its length and depth, some readers may find it challenging to digest all the content, especially if they are new to financial concepts. Nevertheless, this guide remains a valuable tool for anyone serious about achieving financial freedom.

To buy this product, click here.

Trade Your Way To Financial Freedom

Trade Your Way to Financial Freedom is a comprehensive guidebook aimed at helping individuals achieve financial independence through trading. This book is published by McGraw-Hill Education and authored by an expert in the field, providing valuable insights and strategies for both novice and experienced traders.

Pros:

- Provides detailed strategies for successful trading.

- Written by a reputable author with extensive experience.

- Published by McGraw-Hill Education, a trusted name in educational resources.

- Comprehensive coverage with 482 pages of content.

Cons:

- The book’s technical content may be challenging for beginners.

- Publication date of 2006 may mean some information is outdated.

Trade Your Way to Financial Freedom, published by McGraw-Hill Education, is an essential read for those looking to delve into the world of trading. The book spans 482 pages and covers a wide range of strategies that are designed to help traders achieve financial independence. With its second edition, the content is improved and refined to provide even more value to its readers.

One of the standout features of this book is its comprehensive approach. It doesn’t just focus on one aspect of trading but covers various strategies and techniques, making it suitable for both novice and seasoned traders. However, the technical nature of the content might be overwhelming for beginners, and given its publication date of 2006, some of the information might not reflect the latest market trends and tools. Despite these minor drawbacks, the book remains a valuable resource for anyone serious about trading.

To buy this product, click here.

Simple Money, Rich Life

“Simple Money, Rich Life: Achieve True Financial Freedom and Design a Life of Eternal Impact” is a comprehensive guide that aims to help readers achieve financial freedom while living a life of purpose and impact. Authored by Bob Lotich, this book offers practical advice and strategies to manage finances effectively and align them with personal values and goals.

Pros:

- Offers practical and actionable financial advice.

- Focuses on achieving both financial freedom and personal fulfillment.

- Well-structured and easy to understand.

- Written by a reputable author with extensive experience.

Cons:

- May require a mindset shift for some readers.

- Some concepts may be repetitive for experienced finance readers.

“Simple Money, Rich Life” stands out in the crowded field of financial self-help books due to its unique approach of combining financial freedom with personal fulfillment. Unlike many other books that solely focus on wealth accumulation, this book emphasizes the importance of aligning one’s finances with their values and long-term goals. Bob Lotich’s expertise and clear writing style make complex financial concepts accessible to a broad audience, making it an excellent choice for anyone looking to take control of their financial future.

The book’s structure is designed to guide readers through a step-by-step process, starting from basic financial management to more advanced strategies. The practical advice provided is immediately applicable, making it possible for readers to start seeing improvements in their financial situation quickly. However, the book’s emphasis on a holistic approach to finance might require a mindset shift for some readers who are used to more conventional financial advice. Overall, “Simple Money, Rich Life” is a valuable resource for anyone seeking to achieve financial freedom while living a life of purpose and impact.

To buy this product, click here.

Frequently Asked Questions

What Is “the Black Girl’s Guide To Financial Freedom” About?

“The Black Girl’s Guide to Financial Freedom” teaches how to build wealth, retire early, and live your dream life. It’s a practical guide for achieving financial independence.

How Does “the Total Money Makeover” Help Achieve Financial Peace?

“The Total Money Makeover” provides a proven plan to eliminate debt and build wealth. It offers actionable steps and real-life success stories.

What Strategies Are In “the Roadmap To Financial Freedom”?

“The Roadmap to Financial Freedom” details strategies for building automated wealth. It guides readers towards financial independence through smart investing.

Why Read “rich Dad’s Cashflow Quadrant”?

“Rich Dad’s CASHFLOW Quadrant” explains different income sources and financial strategies. It helps readers achieve financial freedom by understanding cash flow and investments.

What Is Unique About “retire Before Mom And Dad”?

“Retire Before Mom and Dad” simplifies the numbers behind financial freedom. It offers practical advice for achieving early retirement and financial security.

Who Should Read “financial Literacy For Young Adults Simplified”?

“Financial Literacy for Young Adults Simplified” is ideal for young adults. It teaches how to manage, save, and invest money for a secure future.

Conclusion

Achieving financial freedom is a journey best traveled with the right resources. The books we discussed provide valuable insights and actionable strategies. They cover everything from early retirement to building wealth and financial literacy. Each book offers a unique perspective that can help you on your financial journey.

Whether you’re just starting out or looking to refine your financial skills, these books are essential. They are easy to understand and provide practical advice. Reading these books can guide you towards a more secure and independent future. Remember, financial freedom is not just a dream.

With the right knowledge and determination, it can become your reality. So, pick up one of these books and take the first step towards your financial goals. Your path to financial freedom starts with the knowledge you’ll gain from these valuable resources.

Happy reading and good luck on your financial journey!